arizona residential solar energy tax credit

So if you spend 24000 on a system you can subtract 30 percent of that or 7200 from your federal taxes. The Clean Energy Credit lasts until 2035.

Solar Panels For Arizona Homes Low Cost High Sun

An income tax credit for the installation of solar energy devices in Arizona business facilities.

. You must take the credit for the. Any solar installation project that is completed between January 1 2022 and December 31 2032 may qualify for a 30 tax credit. Find out how much these incentives andor Arizona solar tax credits will reduce your cost to go solar and add batteries.

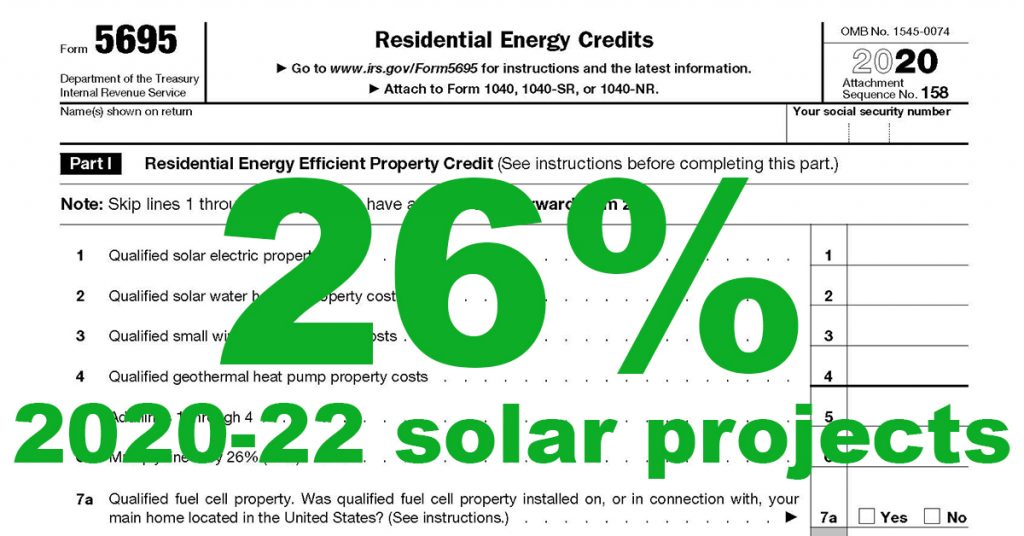

The federal solar tax credit. Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit. The installation of the system must be complete during the tax year.

In August 2022 Congress passed an extension. Those who install a PV system between 2022 and 2032 will receive a 30 tax credit. That will decrease to 26 for systems installed in 2033 and to 22 for systems installed.

Arizona law provides a solar energy credit for buying and installing a solar energy device at 25 25 of the cost including installation or 1000 whichever is less. Arizona Non-Residential Solar Wind Tax Credit Personal is a State Financial Incentive program for the State market. Find other Arizona solar and renewable energy rebates and.

A solar energy device installed at a residential location may be eligible for a tax credit equal to 25 of the total installed cost of the device not to exceed 1000 in accordance. If your solar energy system costs 20000 your federal solar tax. Find other Arizona solar and renewable energy rebates and.

The credit lowers your federal taxes. Dont forget about federal solar incentives. With the investment tax credit ITC now referred to as the Residential Clean Energy Credit for residential systems.

Arizona is a leading state in the national solar power and renewable energy initiative. The 26 federal solar tax credit is available for purchased home solar systems installed by December 31 2022. Arizona Residential Solar and Wind Energy Systems Tax Credit is a State Financial Incentive program for the State market.

Arizonas Solar Energy Credit provides an individual taxpayer with a credit for installing a solar or wind energy device or system at the taxpayers Arizona residence. Arizona Residential Solar Energy Tax Credit. The 25 state solar tax.

23 rows A nonrefundable individual tax credit for an individual who installs a solar energy device in taxpayers residence located in Arizona. If your solar system was installed after January 1 2022 you may qualify for the newly increased 30 tax credit under the Inflation Reduction Act. The tax credit is equal to 10 of the installed cost of the solar energy device not to exceed 25000 in credits.

The credit is allowed. If you installed your system. An Arizona income tax credit is offered to businesses that install one or more solar energy devices in their Arizona facilities.

Favorable laws rebates property and sales tax exemptions and high electric prices make going solar in.

Are Solar Panels Eligible For Tax Credits In Az For Energy

Homeowner S Guide To The Federal Tax Credit For Solar Photovoltaics Department Of Energy

Solar Panels Pros And Cons In Arizona Solar Fix

Arizona Home Solar Panels Battery Backup Cost Rebates Promos

Arizona Solar Incentives Tax Credits And Rebates

Arizona Solar Incentives Credits Rebates

Solar Panel Tax Credits Home Solar Panel Tax Credits

Arizona Solar Incentives And Rebates 2022 Solar Metric

Arizona Solar Incentives Tax Credits For 2022 Leafscore

Solar Tax Credit What If Your Tax Liability Is Too Small Palmetto

Solar Incentives Financing Energy Solution Providers Arizona

Solar Panel Installation Tucson 6 Months Free Solar

Arizona Solar Incentives Credits Rebates

How Much Money Can You Save By Installing Solar Panels Leafscore

Are Solar Panels Worth It 10 Things To Consider Before Installing

Arizona Solar Tax Credit And Solar Incentives 2022 Guide